Israel: The Start-Up Nation

The Israel venture capital (VC) landscape has evolved and grown significantly over the past few decades. With a highly skilled workforce and entrepreneurial ecosystem, the country is now referred to as ”Start-Up Nation”. Therefore, VC investments in Israeli start-ups have grown rapidly, with demand expected to continue unabated.

The Beginning

Yozma

Still in its nascency, the Israeli VC market began gaining momentum in the 1990s, after the government identified the importance of attracting foreign capital, creating the Yozma (Hebrew for “initiative”) program in 1993, which offered attractive tax incentives to foreign VC investing in Israel.

This initiative helped boost the Israeli start-up ecosystem and is seen as a prime example of the government’s VC success. Indeed, between 1991 and 2000, Israel’s annual VC outlays increased by approximately 60-fold, from $58m to $3.3bn. By 1999, the country ranked second in invested private-equity capital as a share of GDP, behind only the US[1].

Many of these foreign funds were American and provided significant and important support for their Israeli investments, particularly by facilitating entry to and scaling up in the US market, among others. In fact, according to IVC Research Center, the US remains the largest foreign VC investor today, accounting for approximately 35% of capital raised by Israeli early-stage companies. Countries including China, UK, Japan, And Germany follow, each holding 3% of capital invested[2].

Yozma was launched at a time where not many domestic Israeli VC firms yet existed. Hence the government required a way to attract additional capital to boost its innovative economy. This was an era prior to the internet, so building a company was much more expensive. Having the capital needed to start a venture was imperative.

Incubators

Another government initiative supporting the Israeli VC landscape was the creation of the Technological Incubators Program in 1991. This platform was launched to leverage the skills of the scientists, engineers, and physicians who emigrated to Israel from the former Soviet Union (USSR). Israel’s Office of the Chief Scientist (OCS), a division of the Ministry of Industry Trade & Labor, started with six incubators to encourage seed and early-stage technological development through entrepreneurship.

Problematically, however, the early version of the incubator program was unsuccessful. It turned out that public servants were not equipped with the right skills to run such incubators. So instead, the Israeli government allowed private companies with VC expertise to get involved. The state received royalties from successful technologies and did not interfere with the day-to-day of development of early-stage companies.

The OCS’s investment has helped boost the Israeli start-up scene. Today there are 24 incubators in Israel and approximately 65% of projects are related to science research and development.

VC in Israel Today

Fast forward to today, where the VC landscape in Israel is very different. Previously, domestic Israeli funds would invest in early-stage companies, and foreign investors would get involved at the Series A funding stage. Nowadays, even foreign VC funds without a permanent presence in the country are investing in Israeli start-ups. This is due to the growing appetite and openness from VCs in trying to spot winning companies before their competitors, which has resulted in even the most risk-averse investors looking into start-ups. Some of the largest VCs based in Israel include Pitango, Vertex Ventures Israel, 83 North, JVP, and more.

Funding Options in Israel

Before the coronavirus pandemic, the Israeli VC market was founder friendly, and funding was widely available through various options, including the Israel Innovation Authority, an independent agency funded by the government to provide support and funding to Israeli early-stage companies. Another is the previously mentioned Technological Incubator program, established in the early 90’s, which offers start-ups conditional awards, access to workspace, legal advice, and support when entering the global market. There are also private incubators managed by Israeli VC funds, or by large corporations and foreign investors, that provide funding and guidance for Israeli start-ups.

Finally, there are many accelerator programs available across Israel. These offer start-ups support and guidance, but in an accelerated manner. Introductions and connections to potential investors, as well as assistance in developing a successful business, are some of the attractive benefits accelerators can provide entrepreneurs.

Covid-19

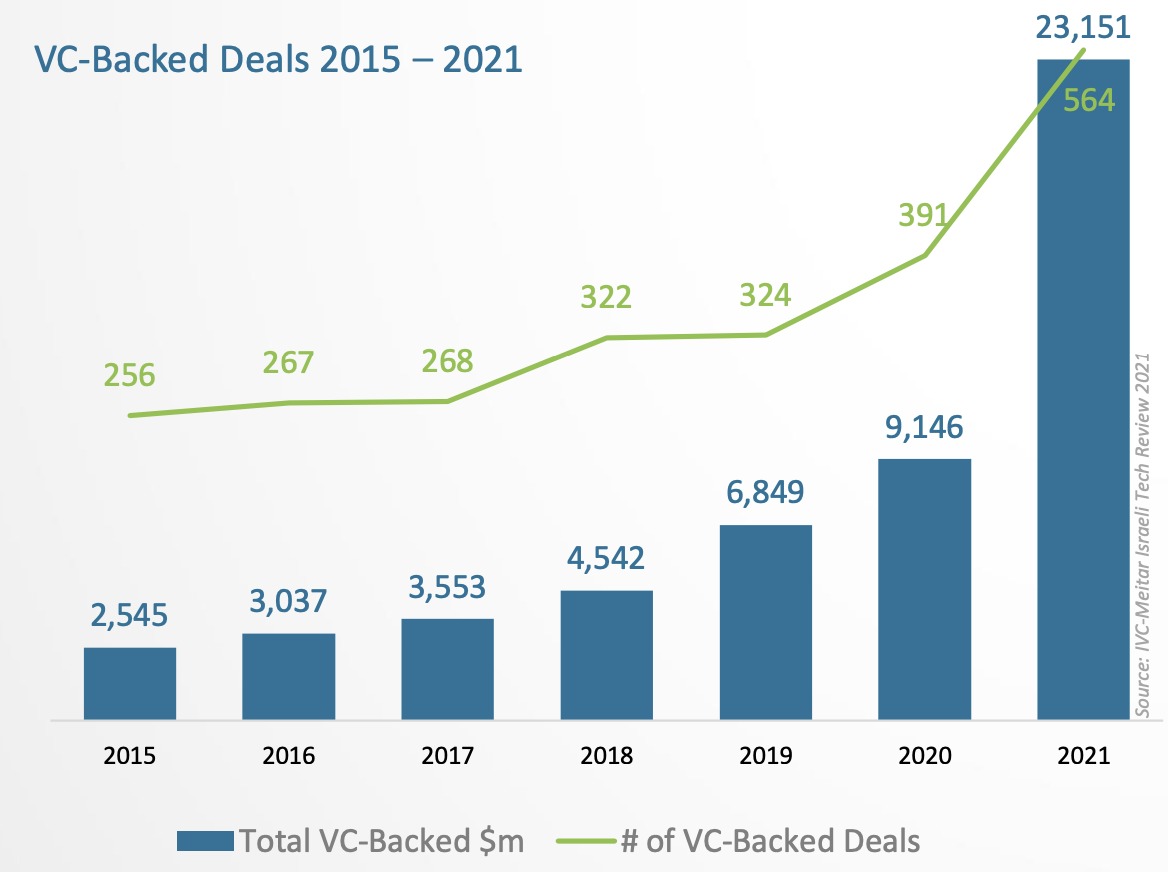

Initially, VCs were more cautious in investing in start-ups during the Covid-19 crisis. But in 2021, VCs invested $25.6bn into early-stage Israeli companies – a leap of almost 150% from 2020, according to IVC-Meitar’s Israeli Tech Review 2021. In fact, investments in Israeli start-ups have been on the rise for the past few years.

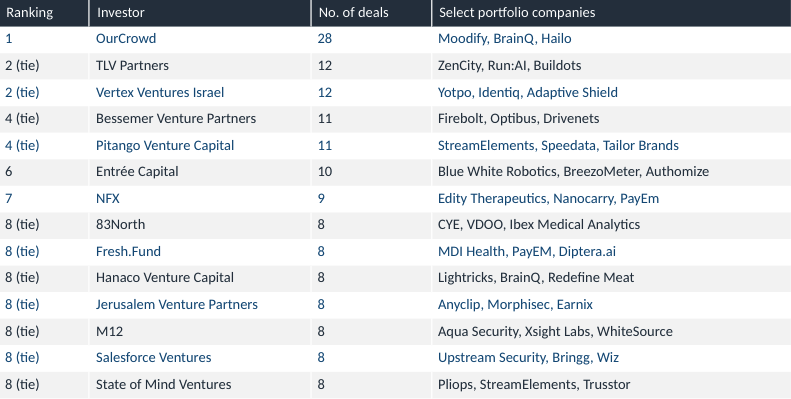

2021 saw record amounts of capital being invested into Israeli start-ups, with the investment platform, OurCrowd, being the most active VC investor in Israel. The VCs that have made the most deals in Israeli start-ups in 2021 include:

Not only are Israeli VC funds raising significant amounts of capital, but foreign investors are expanding their presence in the country. Private equity giant, Blackstone, opened an office in Israel earlier in 2021, and it is reported that Softbank is looking to do the same. Other large VC players that already have locations in Israel include Sequoia and Insight Partners.

Israeli VC Success

Israel remains the leading VC ecosystem in the world. The country produces a disproportionate number of successful start-ups per capita. There are over 6,000 early-stage companies in Israel with a population of 8 million residents[3].

2021 was not only a banner year for VC investments in Israel, but for Israeli high-tech exits, as well, with 238 deals totaling $22.2bn in exit value created for investors[4].

There are also some interesting traits about the VC landscape in Israel that make it unique when compared to other countries. First of all, the small country provides a close-knit VC community, which means that investors tend to co-operate rather than compete with one another. These close VC partnerships and collaborations result in a quicker investment process and, ultimately, more deals being done.

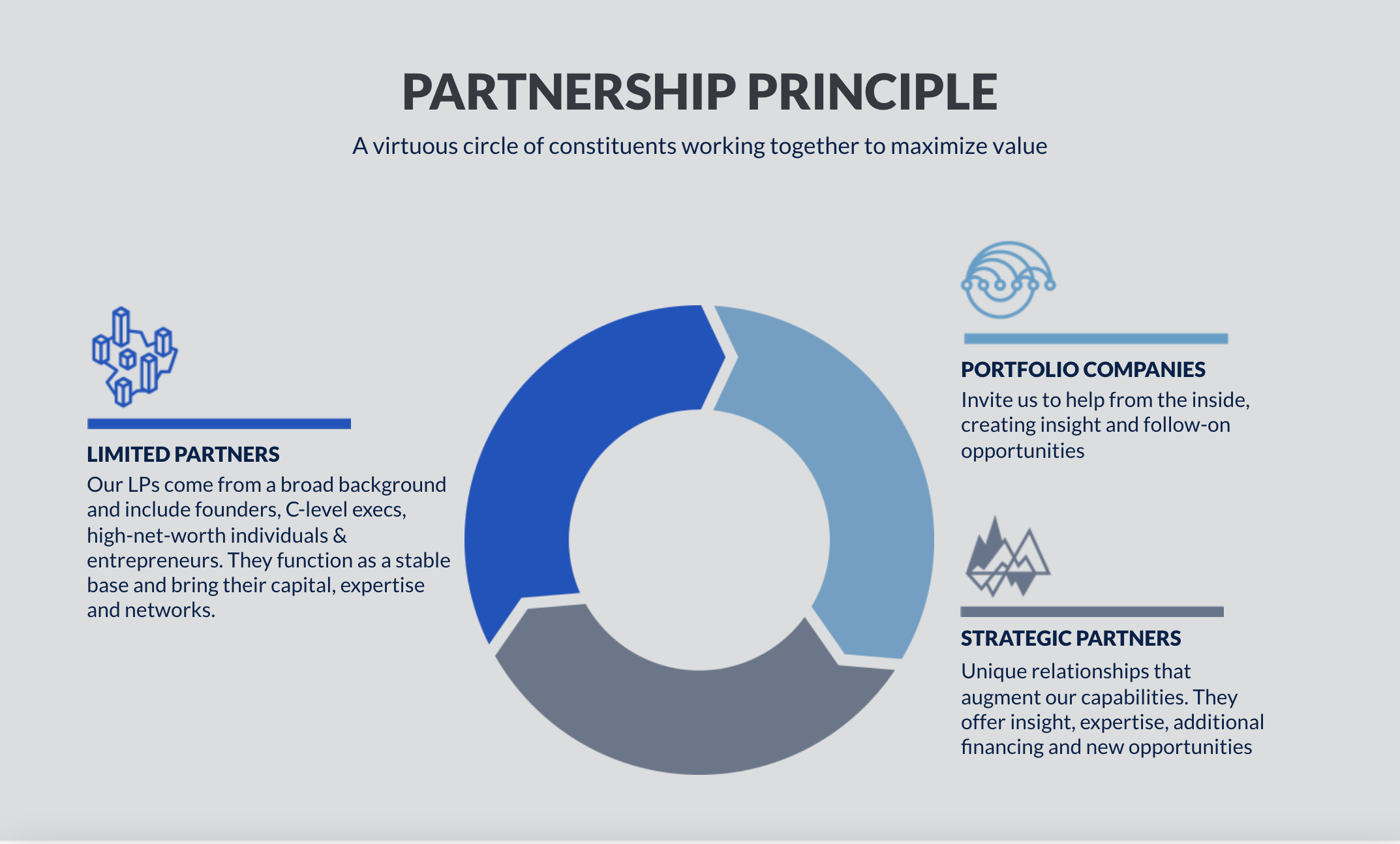

Varana Capital

At Varana Capital, we have developed a strong track record in venture capital, with a particular expertise in and demonstrated success with early-stage Israeli companies. With decades of private and public experience, as both investors and operators, our team offers more than simply capital to our partner companies. Indeed, partnership is central to the ethos at Varana Capital and is encapsulated by what we appropriately term our Partnership Principle: a virtuous circle of elements that combine to maximize value. These elements include our limited partners, our strategic partnerships, and our portfolio companies, all collectively playing a key role in the success of our partner companies and, therefore, the success of our firm.

At Varana Capital, we have demonstrated that Israeli start-ups can deliver outsized returns for investors. Since 2015, we have operated a hybrid, evergreen model that ensures we are aligned with our LPs and our portfolio companies, combining private and public market investing. Indeed, this investment paradigm has proven quite successful for our limited partners, a dynamic that has not gone unnoticed in the investment community, particularly by a few very large, very well-known VC firms that only now are mimicking the portfolio management philosophy that has driven Varana Capital since Day One.

If you’d like to learn more about investing in our flagship Varana Capital Focused Fund or our upcoming All Access Israel Early-Stage VC Fund, please visit varanacapital.com or email us at info@varanacapital.com.